The concept of a “Coin Symbolizing Worthlessness” encapsulates the potential downfall of any cryptocurrency, highlighting the volatile nature of the digital asset market. This article delves into the factors that can contribute to a coin losing its value, becoming a symbol of worthlessness, and explores the broader implications for the cryptocurrency ecosystem.

What Makes a Coin Symbolized Worthlessness?

Several factors can contribute to a cryptocurrency becoming essentially worthless. These range from fundamental flaws in the project’s design to external market forces. Understanding these factors is crucial for navigating the cryptocurrency landscape.

- Lack of Utility: A coin without a practical use case or real-world application is likely to lose value over time. Investors are drawn to cryptocurrencies that offer tangible benefits, whether it’s facilitating transactions, powering decentralized applications, or providing access to exclusive services.

- Failed Projects: Many cryptocurrencies are tied to specific projects or platforms. If the underlying project fails to deliver on its promises or faces technical challenges, the associated coin can quickly become worthless.

- Loss of Community Support: A strong and active community is vital for a cryptocurrency’s success. Loss of community support, due to disagreements, scandals, or simply a lack of interest, can lead to a decline in value.

- Market Manipulation: The cryptocurrency market is susceptible to manipulation, particularly for coins with low trading volumes. “Pump and dump” schemes, where a group artificially inflates the price of a coin before selling off their holdings, can leave other investors with worthless assets.

- Regulatory Changes: Government regulations can significantly impact the value of cryptocurrencies. Bans or restrictions on trading can render a coin effectively worthless in certain jurisdictions.

- Security Breaches: Major security breaches or hacks can erode investor confidence and lead to a sharp decline in a coin’s value. If the underlying technology is compromised, the entire project could be jeopardized.

Hình ảnh đồng coin mờ nhạt, giá trị thấp

Hình ảnh đồng coin mờ nhạt, giá trị thấp

Recognizing the Warning Signs

Identifying potential “worthless coins” requires careful analysis and due diligence. Here are some warning signs to look for:

- Unrealistic Promises: Be wary of projects that promise exorbitant returns or guarantee success. Thoroughly research the team, technology, and roadmap before investing.

- Lack of Transparency: Projects that are secretive about their operations or have a lack of clear communication with the community should be approached with caution.

- Low Trading Volume: Coins with low trading volume are more vulnerable to market manipulation and may be difficult to sell when you want to exit your position.

- Negative News and Controversy: Pay attention to news and social media discussions surrounding a cryptocurrency. Negative press or community infighting can be a red flag.

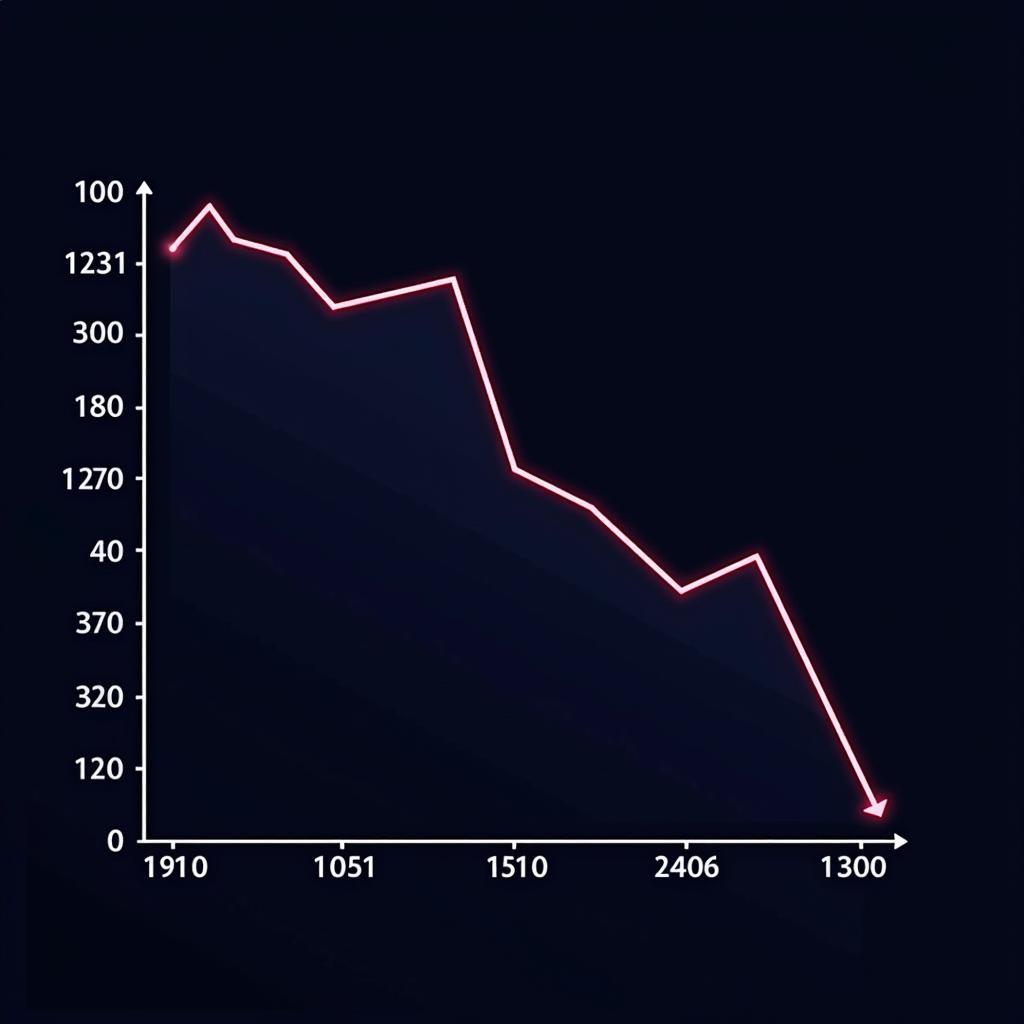

Biểu đồ giá coin giảm mạnh

Biểu đồ giá coin giảm mạnh

The Impact of Worthless Coins

The proliferation of worthless coins can damage the reputation of the entire cryptocurrency ecosystem. It can erode investor confidence and hinder the adoption of legitimate projects. Furthermore, it underscores the importance of responsible investing and thorough research.

What to Do with Worthless Coins?

Unfortunately, there’s often little you can do with a truly worthless coin. It might be a painful lesson in the risks of cryptocurrency investing. Some investors choose to hold onto their worthless coins in the slim hope of a revival, while others simply write them off as a loss.

“Investing in cryptocurrency requires a discerning eye. Don’t get swept up in hype; focus on projects with real value and a solid foundation.” – Dr. Anna Nguyen, Cryptocurrency Analyst

The Future of Cryptocurrency Valuation

As the cryptocurrency market matures, more robust valuation methods are likely to emerge. This will help investors make more informed decisions and potentially reduce the number of coins that become worthless.

Hình ảnh tượng trưng cho tương lai của tiền ảo

Hình ảnh tượng trưng cho tương lai của tiền ảo

Conclusion

The existence of “coins symbolizing worthlessness” is a stark reminder of the risks inherent in the cryptocurrency market. By understanding the factors that contribute to a coin’s decline and recognizing the warning signs, investors can make more informed decisions and protect themselves from potential losses. Remember, thorough research, due diligence, and a healthy dose of skepticism are essential for navigating the volatile world of cryptocurrency. If you need any help, please contact us at Phone Number: 0372960696, Email: [email protected] Or visit our address: 260 Cầu Giấy, Hà Nội. We have a 24/7 customer service team.

FAQ

- How can I tell if a coin is truly worthless?

- Are all low-priced coins worthless?

- What can I do to avoid investing in worthless coins?

- Is there any way to recover my investment in a worthless coin?

- How do regulatory changes affect the value of cryptocurrencies?

- What role does community support play in a coin’s success?

- What are some examples of coins that have become worthless?

Situations where people often have this question:

- After a significant market downturn.

- When researching new cryptocurrency projects.

- When trying to understand the risks of cryptocurrency investing.

- When encountering scams or pump-and-dump schemes.

Related articles and questions:

- What is cryptocurrency?

- How to invest in cryptocurrency?

- Understanding blockchain technology

- Cryptocurrency scams and how to avoid them

We encourage you to contact us if you have any further questions or require assistance. Our team is available 24/7 to help you navigate the world of cryptocurrency.